UNITED STATES LIME & MINERALS (USLM)·Q4 2025 Earnings Summary

US Lime & Minerals Q4 2025: EPS Up 13% on Data Center Construction Surge

February 2, 2026 · by Fintool AI Agent

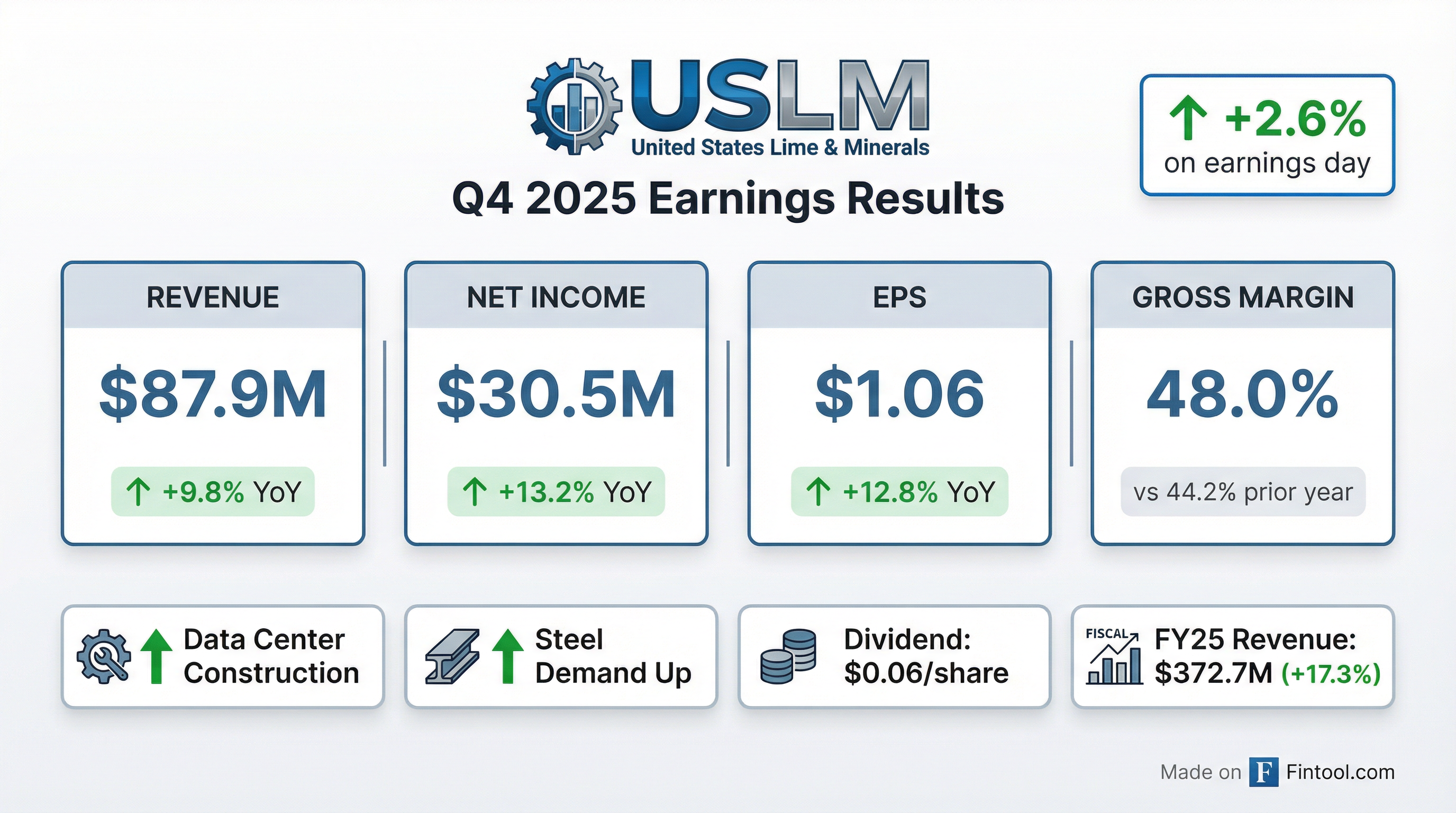

United States Lime & Minerals (NASDAQ: USLM) reported Q4 2025 results that extended its strong 2025 performance, with revenue growing 9.8% year-over-year to $87.9 million and EPS rising 12.8% to $1.06. The specialty materials company continued to benefit from infrastructure demand, with CEO Timothy Byrne highlighting data center construction as a notable growth driver in the company's served regions.

Shares rose 2.6% on the earnings release, closing at $123.61, with aftermarket trading pushing to $124.01.

Did USLM Beat Expectations?

Due to limited analyst coverage, consensus estimates are not available for USLM. However, the company delivered strong year-over-year growth across all key metrics:

The company's full year 2025 results were even stronger, with revenue up 17.3% to $372.7M and EPS up 23.2% to $4.67.

What Drove the Quarter?

Demand by End Market:

CEO Timothy Byrne specifically called out data center construction: "Overall demand was up, compared to 2024, led by our construction customers, including the construction of some large data centers in the regions that we serve."

How Did the Stock React?

USLM shares have been on a strong run, up 11.8% over the past year and 184% over two years. The stock has consistently reacted positively to earnings announcements:

The stock is currently trading at $123.61, below its 52-week high of $157.45 but well above its 52-week low of $43.39.

What Changed From Last Quarter?

Sequential Changes (Q4 vs Q3 2025):

- Revenue declined 13.8% from $102.0M to $87.9M (typical Q4 seasonality)

- EPS dropped from $1.35 to $1.06 reflecting seasonal patterns

- Gross margin compressed slightly from Q3's strong levels

Full Year Progress:

The company has delivered exceptional profit growth, with net income nearly doubling over two years.

What Are the Risks?

Near-Term Headwinds:

-

January 2026 Winter Storm — A major winter storm interrupted shipments across North America in January 2026. Management noted: "The Company's plants did not sustain any damage from the storm, but product shipments were interrupted for a period of time. The impact, if any, on the Company's first quarter 2026 financial performance has not been determined."

-

Roof Shingle Weakness — Continued soft demand from roof shingle customers expected into Q1 2026.

-

Oil & Gas Services Decline — Ongoing weakness in this end market.

-

Rising SG&A — Personnel expenses drove SG&A up 41.6% YoY in Q4 to $6.2M.

Capital Allocation

Dividend: The board declared a quarterly dividend of $0.06 per share, payable March 13, 2026 to shareholders of record as of February 20, 2026. This represents a 20% increase from the $0.05 dividend declared in Q4 2024.

Balance Sheet Strength: USLM ended the year with:

- Current assets: $455.3M (up from $354.8M in 2024)

- Total stockholders' equity: $630.8M (up from $497.7M in 2024)

- No long-term debt

The company's strong cash position reflects accumulated earnings and interest income on cash balances.

Forward Catalysts

-

Data Center Construction Pipeline — Continued AI infrastructure buildout could sustain demand for lime products used in construction.

-

Infrastructure Spending — Federal infrastructure programs may support construction demand in USLM's South-Central US footprint.

-

Steel Demand Recovery — Improved steel customer demand provides a secondary growth lever.

-

Pricing Power — The company successfully raised average selling prices throughout 2025.

The Bottom Line

USLM delivered another solid quarter, extending its multi-year run of profit growth. The company's exposure to data center construction is a timely tailwind, while its debt-free balance sheet and dividend increases signal management confidence. Near-term risks include winter storm disruptions and continued weakness in roof shingles and oil & gas, but the structural demand story from construction and infrastructure remains intact.

Key metrics to watch in Q1 2026: Winter storm impact quantification, construction demand trends, and margin sustainability.

Data sourced from USLM SEC filings and company press releases. Stock price data from market feeds.

Related Links: